Written by: David Omakwu

“The cost of war is not paid in dollars and cents, but in the lives, liberties, and future prosperity of the people.”

– Ludwig von Mises. Omnipotent Government: The Rise of the Total State and Total War. Yale University Press, 1944.

Time fizzled into a simple rhythm: the sleeping sun and wake of the dark moon. Hours, minutes, seconds, whatever measurement of time distilled into the momentary sound of gunshots, explosions, and the enemy’s machetes. I was crippled by fear yet burning with hope that the government forces would rescue us before the enemy forces reached our abode. Buildings from afar erupted you from the slumber of death with loud explosions accompanied by black fumes.

You wonder if your school buddy who lives down the street, whose awesome mum bakes cakes for all her son’s friends every Friday, is still alive. It looks like that is their house burning. You can’t hear your own heartbeat; it’s too loud. Adults are just as scared, if not more. We cover the baby’s mouth every time we hear gunshots as though whoever is shooting these guns is looking for baby cries to submit death to.

I can’t ever remember feeling hungry in those horrific times, for one loses sense of even sense. I can remember, though, in these moments I prayed. I begged the one true God, whoever He was, to help us all. We all lived on this precipice between life and death as precariously as our hopes allowed. What seemed like days passed and the bombings had reduced drastically. The neighbour who lives below us even came out into the yard for a smoke. It was at this hopeful moment whence we all thought the worst of the war had passed us that the bomb went off…, the whole building shook violently.

I remember getting up and seeing everyone scramble in a confused haze of dust and smoke to grab whatever they could. I was too stunned to move. My brother-in-law barked orders at me just as my elder sister, his wife, barked orders at him. I couldn’t hear what they kept shouting, but my sister held onto the two younger children while the husband was frantically picking items from the table and everywhere, while telling everyone to stay down and be ready to move at his command. His wife kept saying she wasn’t moving nowhere. She argued that if we went into the car and tried to make a run for it, we just made ourselves a moving target for either of the warring factions we met on the road. She said that if we got stopped by the enemy forces, the car we were in would be of more value to them than all our lives combined. She concluded with “if it is here the worst shall meet us, then let it come, but I am not running nowhere”. She was right. In that moment, we resolved to just wait for whatever was yet to come. I sat on the floor, stared into the nothingness, and waited.

As an investor, when I hear the drums of war sounding, I ask myself what is the true cost of war? The answer is not measured in portfolios or account balances. Nevertheless, for lack of a better alternative, I will be measuring the cost of war in this letter by the value of my portfolio and account balance when all is said and done. The causes of war in all of time, past and present, are as numerous as the things that bring society to face its fragile union. In modern times, taking the last fifteen years as a case study, wars have erupted to reflect global ideological changes (political, economic and religious), political foundering of governments (especially in developing countries), territorial disputes and a changing global climate.

Across the globe, wars have sprung up: Ukraine V Russia in Europe, Isreal V Palestine, Yemen, Lebanon, Syria, Iran in the Middle East, internal strife within countries in South America with the possibility of a US invasion of Venezuela, Military coups in western Africa, Nigeria and a plethora of African countries struggling with terrorist insurgents, border clashes in Asia; India V Pakistan, Cambodia V Thailand etc. The immediate aftermath of these, or any war, on the financial markets is a significant dislocation in supply and demand forces across economic assets. This dislocation creates a form of momentary chaos in the value of assets globally.

Now, this letter primarily focuses on what the aftershock of wars means to: 1. the value of financial assets, that is, stocks, bonds, commodities, and currencies, 2. portfolio construction in such perilous times, and 3. we conclude with a warning on bubbles that form around the euphoria of war.

WHAT DOES WAR LOOK LIKE IN ECONOMIC TERMS?

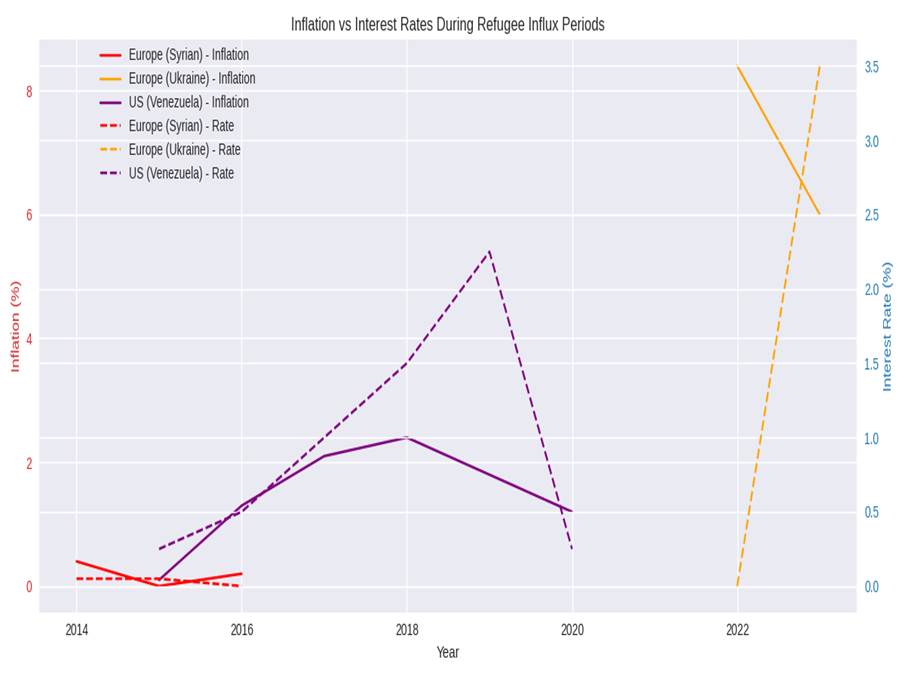

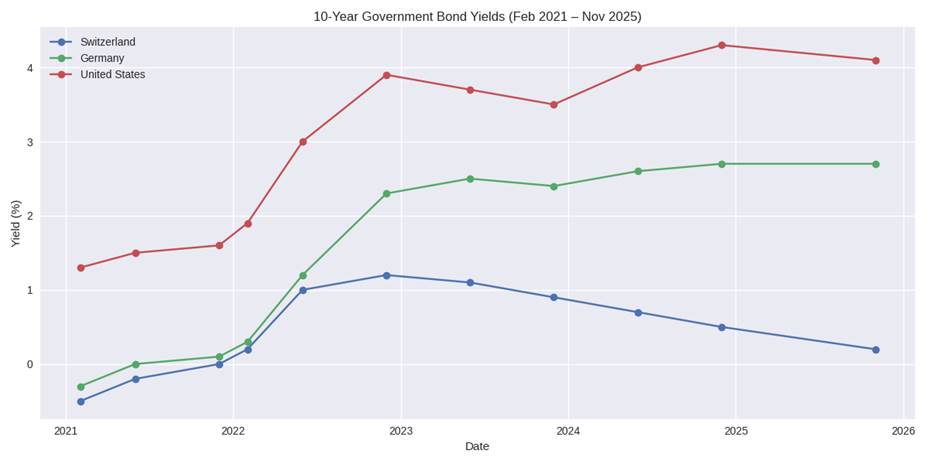

Economic forces of demand and supply are in a constant tug of war themselves, and this results in the moves we see upwards or downwards in the price of assets. Nevertheless, other factors like labour force and population play key roles in an economy, and these forces are directly impacted during war. Therefore, to paint a picture of what war resembles in economic terms we might as well look directly at how it shifts the equilibrium of all other economic factors. Take for instance, the rise in refugee numbers especially from the Middle East. Firstly, governments have had to stretch their countries’ budgets to accommodate the influx. The labour markets have had to provide jobs, however limited. This has directly affected wages in these countries. Central banks have kept shifting interest rates higher or holding interest rates high to counterbalance immediate inflationary pressures put on by the sudden population influx. One must understand that this is more a case of correlation rather than causation.

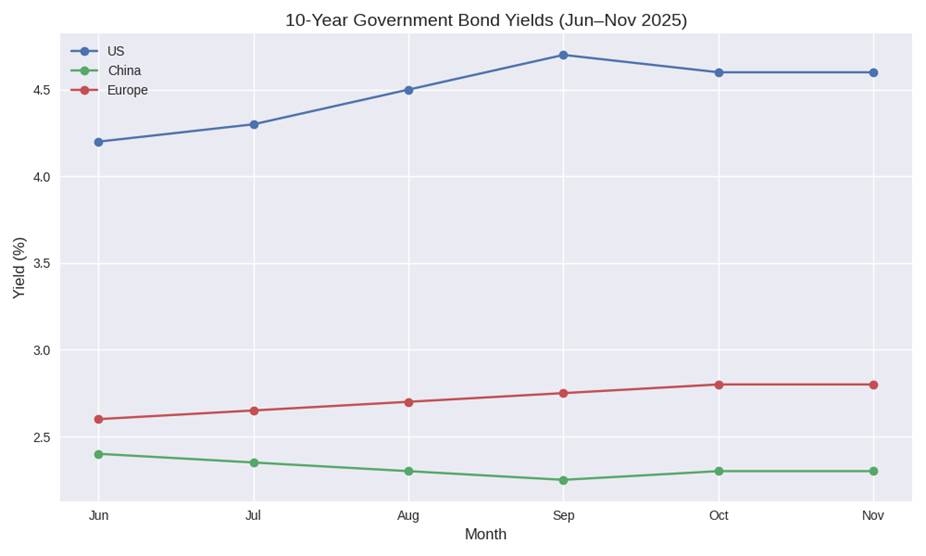

One can even argue that there is a direct correlation between inflationary pressures, especially as noticed in Europe and America, and the hike in interest rates during the period. This is not to blame immigrants or refugees, for I am an immigrant also. However, this is to point out that market sentiment drives largely the economic shocks that reflect in the economic data and the economic data reflects invariably in asset prices. The sentiment in focus is how investors react to war or data surrounding war. Now let’s look at bond prices in Europe, America, and China, and one can see that the falling bond prices in Europe and the US are a result of the interest rate hikes. China, on the other hand, has not been a major recipient of refugees within the same period, and its central bank has been on the opposite trajectory to Europe and America, instead cutting interest rates to stimulate growth. Its bond prices have also been on the rise. Again, this letter is not to ignore the humanitarian crisis and the olive branch offered by countries that receive refugees, but rather to look at market sentiment toward war and how it affects asset prices.

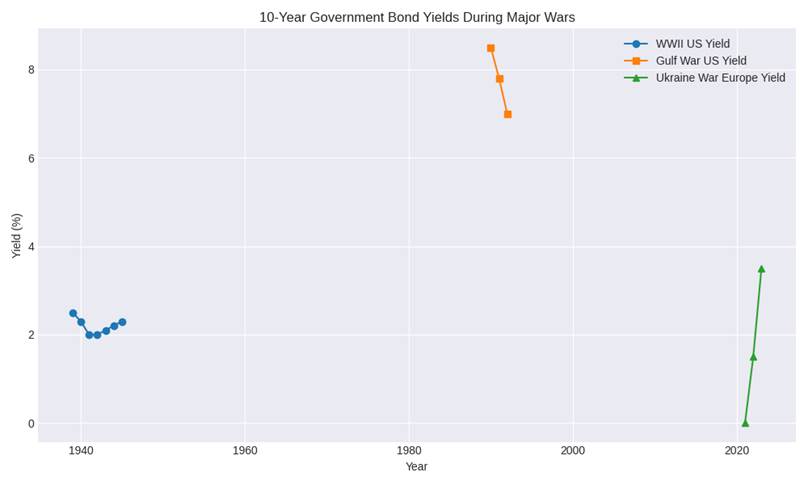

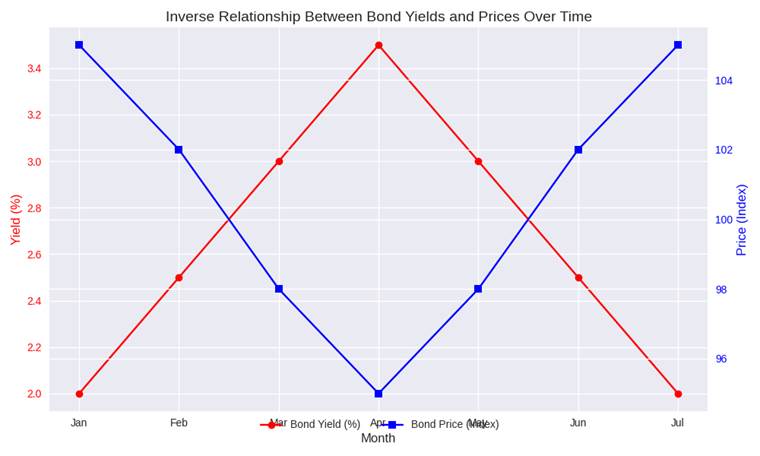

Nevertheless, war creates uncertainty and during periods where war breaks out, the market’s initial sentiment is to run to safe-haven assets. Bonds top the list of safe-haven assets. During this period, we see bond prices rise sharply, and yields fall not minding the fundamentals in the economy at such periods.

Do we therefore conclude that China’s disparity in data is because of her refugee policy within the period or bond yields falling across board in other major economies is due to their refugee policy? Bonds are a quick fix for a portfolio during war times especially bonds of stable economies but, overtime the bond markets recalibrate to reflect the economic data sets driving the economy. Thus, for a portfolio looking to outperform even, after the war, I will enjoin you to let the data speak to you.

If bonds are not the safest of assets during war time, then what is a safe-haven asset?

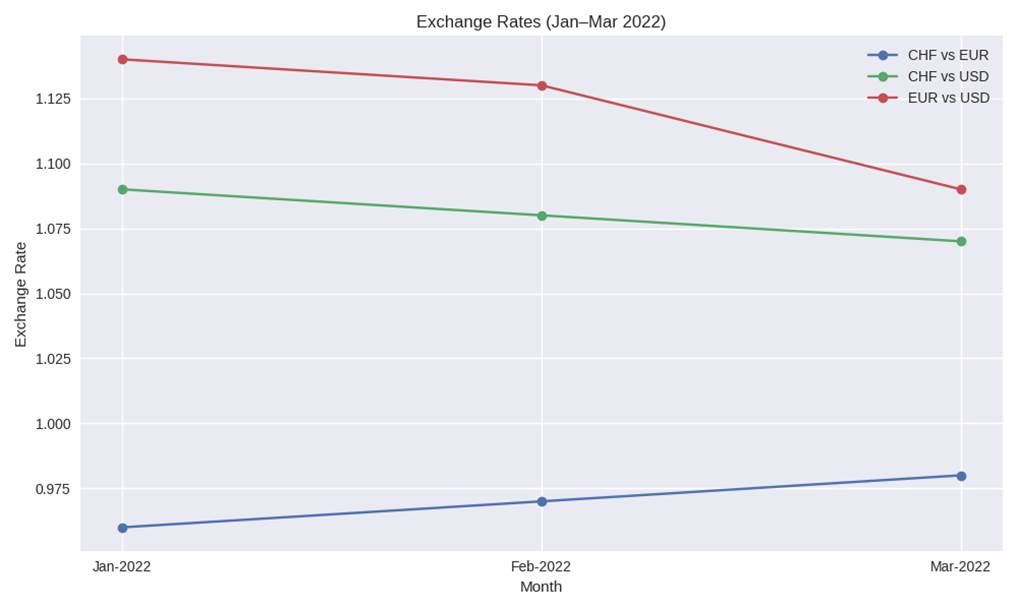

The very idea of a safe-haven asset reflects the illusory nature of the markets. The financial markets are roiled in cycles. These market cycles are caused by a plethora of factors operating in an economy and in the markets at any point in time. My job as an investor is to identify a market cycle and take as much economic advantage of it as possible. Events like war create a shift in market cycles either temporarily or otherwise. This shift allows for investors to neglect all other market data and in a sentimental fit, run to what markets overtime has identified as safe-haven assets. Let’s look at the currency markets to better explain this point. At the onset of the Russo-Ukraine war in late February 2022 the Swiss franc (one of the safe-haven currencies) gained almost 3% against the Euro. Both currencies are in same geographical region, same economic region and same proximity to the warring factions (at least continentally). So, the question is why the sudden rise in Swiss franc against the Euro? The answer is that the Swiss Franc is seen as a safe-haven asset. What makes an asset a safe–haven asset? In this case it’s simply the political neutrality of Switzerland. Other factors like liquidity and inverse correlation of certain assets to perceived risk are also reasons for terming an asset a safe-haven asset.

Figure 6: Exchange rate of the Swiss franc against the Euro and the US dollar at the onset of the Russo-Ukraine war

Looking at this, one can see that market sentiments and euphoria are the major drivers of asset pricing in this situation. safe-haven assets in war are assets that investors use to chase the illusion of safety in a chaotic reality. My premise doesn’t try to negate the fact that safe-haven assets present an opportunity for gains during war, but to point out that these assets are more of an immediate cushion fuelled largely by speculative euphoria. The length of time an investor can safely hold these assets in their portfolio is largely determined by how long the market euphoria last.

Since war in all its ramifications is chaotic, the question then becomes what assets best represent the reality of this chaos? Simply put: Defence stocks. Wars are fought with weapons, so it is basic demand and supply rule that defence stocks get to see significant gains around this period. Three defence stocks that helped our portfolio gains significantly during this period: 1) Lockheed Martin (LMT) with roughly about 27% gain, 2) General Dynamics (GD) 72% gain, 3) Airbus SE (AIR) 83% gain.

Figure 7: Our most profitable defence stocks (2021-2024)

The outsized gains in these defence stocks within the period is not a reflection of exceptional stock picking skills on our part but rather being able to read the market cycles and deviations to the cycles. When Ukraine was invaded, a host of her allies; USA and other major European countries started investing billions of dollars into defending Ukraine. We simply followed the money, and a better chunk of it went into defence companies. The general market cycle for defence, aviation and logistics before 2021 was quiet except for logistics companies that were recovering from COVID-19 shocks (2020). When we noticed a sharp uptick, especially in defence stocks, around this period, we understood the primary cause to be the war, and then the secondary cause to be investments in defence spending, especially in Europe. At the prices we got into these stocks, we did not expect to hold them on our books longer than twelve months, but then the war has unfortunately lasted longer than anyone thought.

While simple opportunities like this arise, there is a much larger and somewhat complex weapon used during wars that we have also seen its use become more prevalent recently; that is the weaponisation of asset-holdings by countries. The ripple effect of this cut across asset classes but in recent times we have seen this most in the commodities market. For example, when Russia weaponised her oil and gas exports in response to sanctions placed on her economy, European countries felt the full weight of this punch as the region relied heavily on Russia for a huge part of its energy demand. The ripple effect globally was the rise in Brent crude above 100 dollar per barrel. Even countries that don’t depend on Russian supply for their energy demands were still affected by the higher energy prices. This trend has continued even now with China selling some of its dollar-denominated assets (de-dollarization) and exercising greater supply controls on rare earth metals. This trend has also contributed to the astronomical rise in the price of gold as central banks have increased their holdings in the asset in a bid to diversify away from the dollar, although, this is also in some part amplified by a speculative bubble in the metal.

During war, financial assets can experience speculative bubbles largely because supply constraints are exaggerated during this time and investors rush to take advantage of every shiny new opportunity. When war happens especially between major economies, investible assets can see a significant fall, especially, equities with significant exposure to the war or other risk factors like sanctions. As a result of this, investors look to economies that have strong investible assets that have little to no correlation to the broader market risk. An example of this is the current AI bubble that is playing out. There are other factors responsible for this (and that will probably be another investor letter) but war magnifies the disjoint between supply and demand for investible assets.

Final thoughts:

When all the violence was over, and the government forces took back control of our state, there was an indescribable feeling that hung over the place. Even as a child, I found it most difficult to put into words for the experience of war had left a dark void in the heart of all who survived. We picked ourselves up; traders opened their stalls if there were still standing, banks opened their doors, cars started to move on the roads again, schools started reopening. We the survivors pretended we had each not just lost a part of ourselves to the madness of war.

As an investor, I know the value of what is lost during war is beyond measure, but I do my part to ensure that survivors of the abyss can stare into a new horizon and have something substantial to build their lives upon. Investing during war or talking about it sounds shameless but the very nature of war is of itself a most shameful act. The drums of war are getting ever louder and as I cannot bring humanity to not consume itself through war, I might as well advice it on the impending risk and how to mitigate it so that when all is said and done, there will be something left to build up from. This letter covers only a fraction of what investors can do during times of war, and does not exhaust the options.

To survive wars as investors:

1. We must not deny the probability of its occurrence.

2. We must look sincerely, without bias or prejudice to the factions at war and evaluate from that point how exposed our portfolios are.

3. We must then do everything within our reach to expunge or reduce said exposure to the barest minimum.

4. We must then construct a portfolio that has little to no correlation to the risk.

5. Our portfolio construction must reflect a great deal of diversification such that it is not exposed beyond necessity to any one industry, asset class, or economic driver.

6. Our portfolios must be future-proof. That is, it must be one that can go on producing outsized returns well after the war.

Having seen the reality of war and violence as a child, I am the last person who wants to see a repeat of it, but like I stated earlier, denying its probable occurrence does not negate its eventuality. Nevertheless, there are a plethora of factors that could help bring us back from the precipice. One major event will be the US midterm elections next year. The result of this alone may be decisive enough to shift US foreign policy and, by extension, prompt a global shift in politics and economic relations.

After the Nigerian civil war, the military ruler at the time famously declared:

“No Victor, No Vanquished”

Should war ever come, as it already has, I would rather not be vanquished.